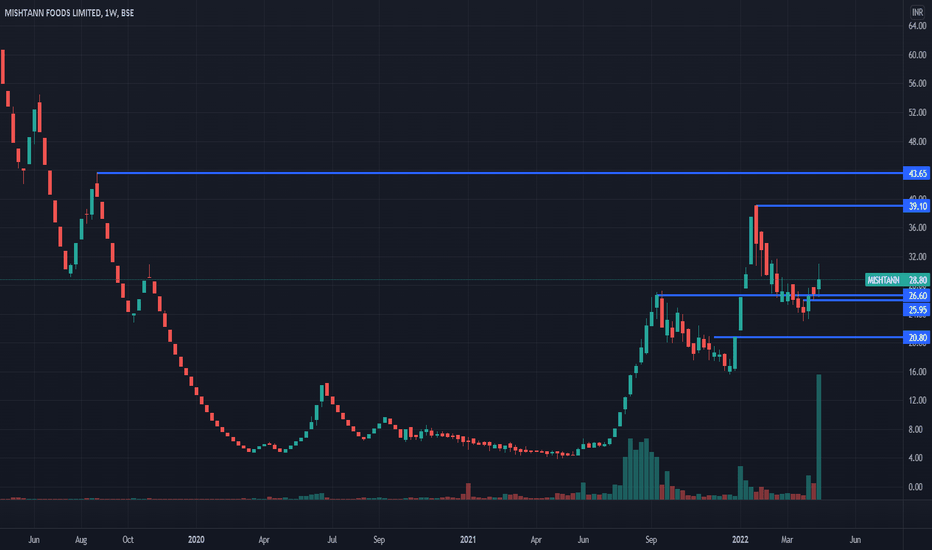

Mishtann Foods Share Price has caught the attention of many investors lately. With recent performance showing impressive growth, the stock has been a hot topic in the market. Shares of Mishtan Foods have risen dramatically, making it one of the most talked-about stocks in the rice industry. From a low of ₹7 in May 2023, the stock has skyrocketed, delivering returns of up to 130% to its investors.

In just one year, Mishtann Foods Share Price has shown a multibagger return of 72%. This surge in value has been driven by the company’s plans to expand globally. With a strong portfolio of Basmati rice products and strategic positioning, Mishtann Foods aims to make its mark in the international market. But is this growth sustainable? Let’s dive into the details of what’s driving the stock price up and what investors can expect in the future.

Understanding the Rise of Mishtann Foods Share Price: A Detailed Overview

Mishtann Foods has become a hot topic in the stock market recently, with its share price seeing impressive growth. The company, known for its Basmati rice products, has shown significant movement in its stock value. Investors who bought shares when the price was low have seen great returns. In May 2023, the stock was at ₹7, and since then, it has climbed to much higher levels, bringing big profits to those who invested early.

The rise in Mishtann Foods’ share price is mainly due to the company’s solid business strategy. By offering high-quality rice products and expanding its reach, the company is gaining attention from investors. The increase in the share price reflects the growing confidence in Mishtann Foods’ future. As the company continues to focus on global markets, it is likely that the stock will remain a key player in the rice industry.

Why Mishtann Foods Share Price Is Gaining Popularity in the Stock Market

Mishtann Foods Share Price has been on an upward trend, and there are several reasons for this. One of the main factors is the company’s strong performance and consistent returns to investors. In the last year, the stock has delivered a 72% return, which has grabbed the attention of many investors looking for growth opportunities.

The company is also preparing to expand globally, which could bring even more growth. Mishtann Foods is known for its premium Basmati rice, and with plans to enter new markets, the company’s future seems bright. This expansion into international markets could lead to increased sales and, in turn, boost the company’s stock value. Investors are excited about the potential of Mishtann Foods, which is why the stock price is seeing such positive movement.

Global Expansion Plans Fueling Mishtann Foods Share Price Growth

Mishtann Foods’ future looks bright because of its plans to expand internationally. The company has made it clear that it wants to deliver premium-quality rice to customers around the world. This expansion is expected to increase the demand for its products and, in turn, could have a positive effect on its share price.

- Expanding market reach: Mishtann Foods is aiming to enter new markets, which will likely increase its sales and brand recognition globally.

- Higher demand for Basmati rice: With global customers looking for high-quality rice, Mishtann Foods is well-positioned to meet this need and capture a larger market share.

- Stronger position in the global market: By expanding globally, Mishtann Foods could create a stronger presence in the competitive rice industry.

All these factors contribute to a brighter future for Mishtann Foods, and the stock price is expected to continue growing as the company enters new markets.

How Mishtann Foods Has Delivered a 130% Return in Less Than a Year

The increase in Mishtann Foods’ share price has been remarkable, with the stock delivering an impressive return of 130% in less than a year. This growth has come from a combination of factors, including the company’s strategic decisions and the rise in demand for its Basmati rice. In May 2023, the stock was priced at ₹7, and by the end of the year, it had jumped significantly.

The company’s focus on quality and expansion has driven investor interest. The rise in Mishtann Foods’ share price shows that investors have confidence in its ability to continue growing and succeeding in the market. As the company pushes forward with its plans, the potential for more growth is high, which is great news for anyone holding its stock.

Mishtann Foods Share Price and Its Competitive Advantage in the Rice Market

Mishtann Foods has a competitive advantage in the rice market that is reflected in its share price. One key factor is the company’s ability to provide high-quality Basmati rice at competitive prices. This makes Mishtann Foods a popular choice for both domestic and international customers.

- Quality of product: Mishtann Foods is known for its premium Basmati rice, which sets it apart from competitors in the market.

- Strategic location: The company is based in India, where Basmati rice is grown, giving it easy access to a key agricultural resource.

- Strong market presence: With years of experience in the rice industry, Mishtann Foods has established itself as a trusted brand.

These advantages give Mishtann Foods an edge over competitors, which helps support its rising share price.

What’s Behind the 72% Growth in Mishtann Foods Share Price in Just One Year?

Mishtann Foods has shown significant growth in its share price over the last year, with a remarkable 72% increase. This growth has been driven by several factors, including strong business performance and positive market trends. The company’s decision to expand its global presence has also played a major role in this growth.

Key Factors Behind the Growth:

- Expansion plans: The move into international markets has boosted investor confidence.

- Quality product offerings: Mishtann Foods’ focus on premium-quality rice has helped attract customers both locally and globally.

- Market trends: The growing demand for Basmati rice in global markets has also contributed to the rise in share price.

As the company continues to expand and increase its market share, the share price of Mishtann Foods is likely to keep growing.

Risks and Rewards: Should You Buy Mishtann Foods Share Today?

While Mishtann Foods Share Price has seen great growth, it’s important to weigh both the risks and rewards before making an investment. The company’s global expansion and quality products position it for continued growth, but there are always risks in the stock market.

- Possible rewards: If Mishtann Foods continues to expand globally and deliver high-quality products, the stock could see further growth.

- Possible risks: Any challenges in the global market or changes in the rice industry could affect the company’s performance.

Before buying, it’s important to carefully consider these factors to make an informed decision.

Conclusion:

Mishtann Foods’ journey from ₹7 to becoming a multibagger stock is a testament to its robust business strategies, quality product offerings, and global ambitions. The impressive 130% return in less than a year has positioned the company as a rising star in the rice industry, drawing the attention of investors seeking growth opportunities.

While the company’s global expansion and competitive advantages indicate a promising future, potential risks such as market volatility and global trade challenges must be considered. Investors should weigh these factors carefully and align their decisions with their financial goals.

With its strong foothold in the Basmati rice market and ambitious growth plans, Mishtann Foods remains a stock to watch. Whether you’re a seasoned investor or a newcomer, keeping an eye on this dynamic player could pay off in the long run.